Comparing Methods for Investment Decision Making in Energy Generation: Why LCOE Is Not Ideal Anymore

(Solar & wind system)

Electricity generation companies have traditionally relied on the levelised cost of electricity (LCOE) to determine the feasibility of their power plants. While LCOE provides a financial analysis of the cost per unit of energy produced, it has several drawbacks. For example, it only considers the cost and overlooks other important factors such as benefits. The LCOE method relies heavily on cost assumptions as well, which may not always be accurate. Also, it does not account for the time-effect of energy generation, such as the fact that a solar system cannot generate energy at night when the energy price may be higher.

To address these limitations, other methods have been proposed, such as a comprehensive levelised cost calculation that includes not only LCOE but also LCOS (levelised cost of storage, particularly in battery storage scenarios), LACE (levelised avoided cost of electricity), BCRA (benefit-cost ratio analysis), and ESA (energy system analysis). This article will explore the advantages and disadvantages of each method and propose a practical approach based on my personal experience with various energy corporations, ranging from large firms to small generation companies.

Traditional LCOE Method

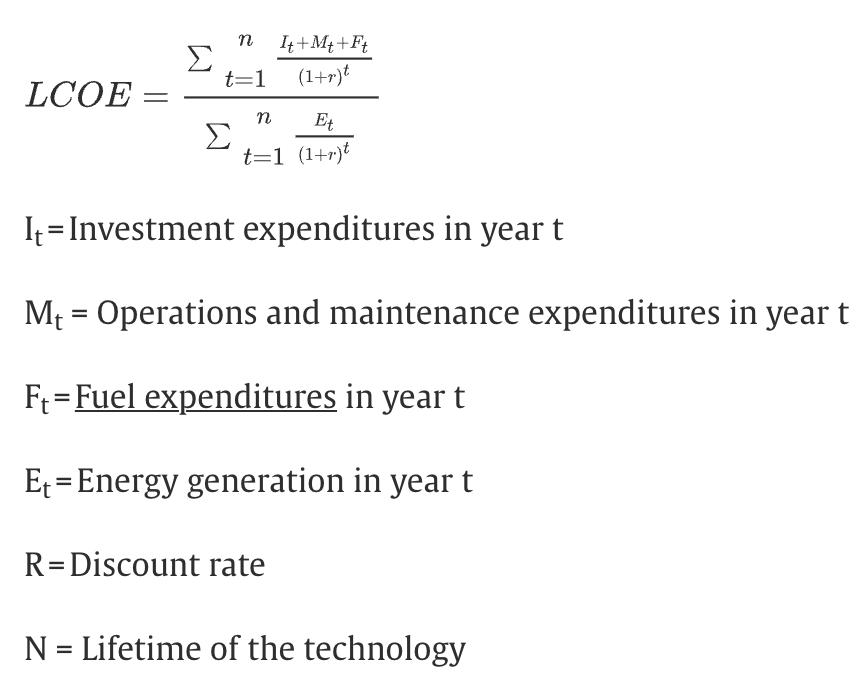

The LCOE method is widely used for making investment decisions in electricity generation. It is expressed in the following formula:

(Hansen, 2019)

The result obtained from this method represents the average discounted revenue per unit of energy output over the system’s lifetime. It takes into account the investment expenditure, O&M costs, fuel expenditures (which are typically zero in renewable energy projects, except for biomass projects), and the amount of energy generated over the lifetime. By calculating the price per energy, it can be compared to the electricity market price. If the latter is higher than the LCOE, the project would be considered profitable. However, this evaluation overlooks several factors related to the system. Technically, it fails to consider the quality of energy, system costs, construction time, and other relevant factors. Economically, it neglects factors such as forced retirements and opportunity costs. Financially, it is one-dimensional, as it only considers the cost side effects and relies on assumptions that are subject to change during the system’s lifetime. For instance, in some of the projects I have previously participated in, the assumptions were overly optimistic about the interest rate and exchange rate, which turned out to be a significant mistake. Additionally, it is argued that the method neglects externalities such as environmental implications (e.g., CO2 emissions).

Comprehensive LCOE + LCOS + LACE

In light of the aforementioned drawbacks, there have been proposals to augment the LCOE method by incorporating additional factors such as tax and land costs. Moreover, due to the increasing prevalence of co-located or interconnected battery systems, a similar method for evaluating storage systems has also been proposed: the LCOS (Levelised Costs of Storage), which enables companies to make more informed decisions by considering the financial implications of storing excess energy for future use. Another proposed method, the LACE (Levelised Avoided Cost of Energy), is used to assess the avoided costs associated with alternative sources of energy generation on an annual basis. When the LACE/LCOE ratio is greater than 1, the project is considered economically viable.

However, these methods still do not address the limitations of the LCOE method, which is essentially a one-dimensional approach that only considers measurable financial costs. Other methods have been proposed and used primarily in academic analysis, but we are now seeing their increasing adoption in decision-making processes for government policies and corporate investment decisions.

BCRA

The Benefit-Cost Ratio Analysis is one of the newer methods proposed to help in deciding whether a system is feasible to invest in. As the name indicates, the BCR is a ratio of discounted value benefits over costs of a system. If the BCR is over 1, it means that the system has a positive return and thus makes financial sense to invest in the project. The BCRA method tries to emphasise the benefit side with a monetised value, as well as the cost side. As BCR is only a ratio and does not have a unit value, it avoids assumption problems like the one of high exchange rate fluctuation mentioned in the above section. However, this simplicity also means that it is a “closed” system method, and like the LACE/LCOE ratio method, it may be difficult to compare a certain BCR with other sources/scenarios.

ESA

ESA, or Energy System Analysis, has been proposed to analyse the entire energy system considering different kinds of energy sources. It analyses the whole system in many aspects, not just the cost or revenue sense, but also factors like CO2 emissions. ESA is also used to analyse the system from a particular energy source to get the whole picture of the project in different dimensions. However, there are some clear drawbacks to this method in the decision-making process for a particular company.

Firstly, the calculation is a huge workload, especially for smaller generation companies. Even if some factors are already predetermined by the company, there are still doubts about how they can be compared with other systems to help the final decision-making, as ESA gives a panoramic idea of the system, which differs depending on the particular project. Another drawback is that while ESA can demonstrate new factors like CO2 tax, which are difficult to be reflected in other methods, there is no clear indication or threshold about how it can be applied in deciding the feasibility of investment.

Conclusion

In my experience, generation companies use a mix of different methods to help make the final investment decision. Although I have seen some companies “adapt” to new methods to justify their investment decisions, in most of these cases, the decision is already “pre-determined”, and some companies just try to find the “correct” method that can give maximum justification. However, the LCOE method is still quite dominant in decision making for investment, especially for smaller generation companies. I would suggest that corporations should be aware of the drawbacks of different methods and make decisions based on comprehensive investigations, whether measured by financial figures or risks matrix using qualitative studies.

References

Abdelhady, S., 2021. Performance and cost evaluation of solar dish power plant: sensitivity analysis of levelized cost of electricity (LCOE) and net present value (NPV). Renewable Energy, 168, pp.332-342.

Hansen, K., 2019. Decision-making based on energy costs: Comparing levelized cost of energy and energy system costs. Energy Strategy Reviews, 24, pp.68-82.

Lai, C.S. and McCulloch, M.D., 2017. Levelized cost of electricity for solar photovoltaic and electrical energy storage. Applied energy, 190, pp.191-203.

Jamil, S.R., Waqar, M. and Shahzad, M.K., 2022. The role and impact of costing methods in determining the viability of energy systems. Energy Conversion and Management: X, 16, p.100303.

Shen, W., Chen, X., Qiu, J., Hayward, J.A., Sayeef, S., Osman, P., Meng, K. and Dong, Z.Y., 2020. A comprehensive review of variable renewable energy levelized cost of electricity. Renewable and Sustainable Energy Reviews, 133, p.110301.

0 Comments